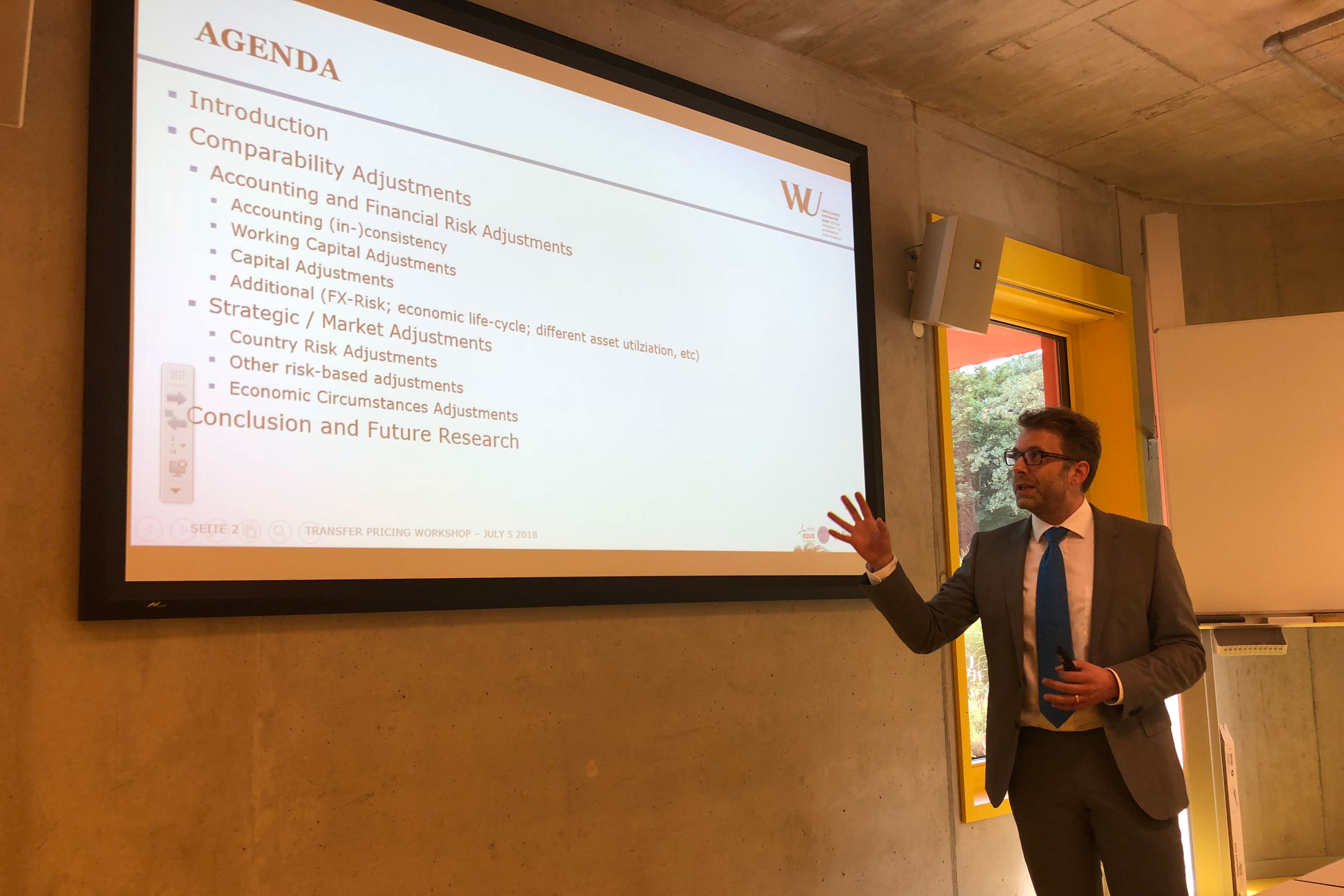

TPED and WU (Vienna University of Economics and Business) Associate Professor Matthias Petutschnig launch the “Comparability Research Project (2018-2019)”. The project aims at identifying solutions to cope with the lack of comparables in emerging economies and developing countries.

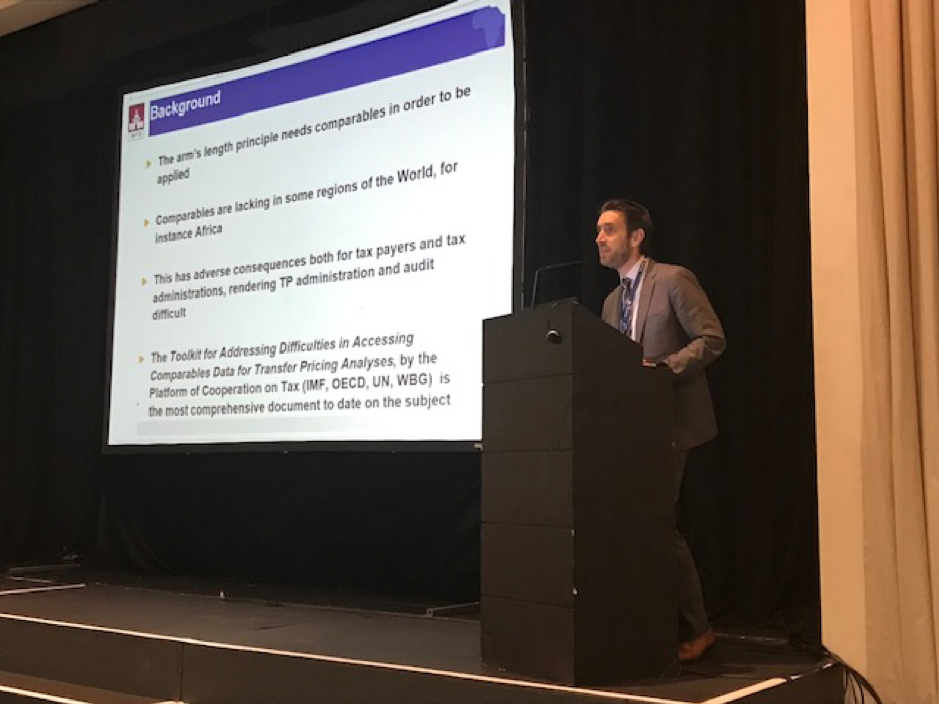

The absence of domestic comparables has been pointed out by the Platform for Cooperation on Tax (IMF, OECD, UN, WBG ) as one of the major obstacle to apply the arm’s length principle in emerging economies and developing countries. In its Toolkit for Addressing Difficulties in Accessing Comparables Data for Transfer Pricing Analyses, the multilateral bodies call for additional economic research, notably in the field of comparability adjustments.

Sébastien,

Romero,

Ednaldo,

Martin,

Emily,

Bert,

Christof,

Vladimir,

comparability,

adjustments,

comparables